The Federal Housing Finance Agency (FHFA) has announced the official loan limits for 2025. The FHFA determined that property values have increased by 5.2% on average from the end of 2023 to the end of 2024. This increase determines the 2025 loan limits so they have increased that to the same percentage.

2025 Conforming Loan Limits

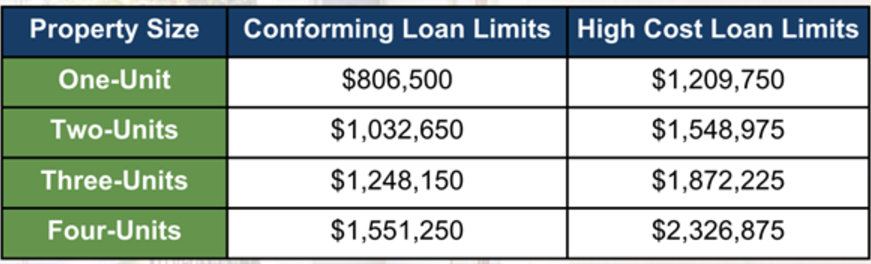

For a single family home the new 2025 conforming loan limit is $806,500. This has increased from the 2024 loan limit of $766,550.

If you live in an area that qualifies as high cost the new 2025 loan limit is $1,209,750. This limit was $1,149,825 in 2024.

What is a Conforming Loan

There are several benefits to a conforming loan product. Conforming loans have competitive interest rates, faster loan underwriting, more loan term options and escrow account options that allow you to pay your taxes directly to the city you live in.

In order to qualify for a conforming loan product you will need to have a credit score of at least 620+ and you will need to have at least a 3% down payment on the property. Your debt to income ratio will need to be below 43% and you will need to show stable employment history verified by pay stubs, tax returns and w-2’s.

If you meet these personal requirements you will need to to make sure that the property you are purchasing meets the 2025 conforming loan limits.

The Legacy Mortgage team collectively boasts over a 135 years of industry experience and is well versed in a variety of loan programs including fixed mortgages, ARMs, VA loans, FHA, first time homebuyer and more! We have the privilege of partnering with the best local agents, appraisers and attorneys the Upper Valley has to offer. When you work with Legacy Mortgage you are working with the best local professionals from beginning to end. Reach out to the Legacy Mortgage team to get the loan process started. Call us today, 603-643-7400.